Market Trends:

South America

Finance Headlines

-

Chileans Rush to Explore USD Investments Amid Economic Instability

In recent years, Chile has faced increasing economic challenges, including fluctuating commodity prices, political uncertainty, and inflationary pressures. These factors have significantly impacted the value of the Chilean peso (CLP), prompting many Chileans to explore alternative ways to safeguard their wealth. One increasingly popular strategy is investing in US dollars (USD), a globally recognized safe haven currency.

-

Central Bank of Colombia Surprises with Smaller Rate Cut Amid Inflation Concerns

In a surprising move, the Central Bank of Colombia lowered its interest rate by 25 basis points (bps) in its final meeting of 2025, signaling a cautious approach to monetary policy. For Colombians, this means borrowing costs will decrease, but not as quickly as some hoped. Businesses and households may face a slow road to economic recovery, especially if inflation doesn’t ease significantly or global conditions worsen.

-

LATAM Investment Summit: A New Era of Latin American Investment in Miami

Miami will once again become the epicenter of Latin American business and investment as some of the wealthiest and most influential families from the region convene for the LATAM Investment Convergence Summit. The event, taking place October 8-9 at the JW Marriott Miami, promises to redefine investment strategies, foster sustainability, and advance technological innovation across Latin America while fortifying economic ties with the United States.

How We Help Foreign Investors Thrive!

-

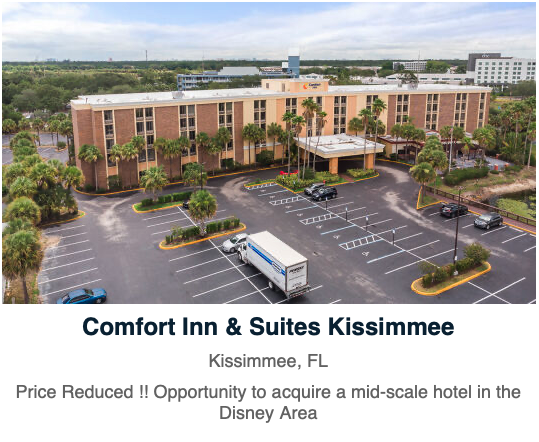

Real Estate Investments

We offer expert advice to find residential, commercial, and development properties with high profitability potential. From property purchases to real estate investment projects, we guide you every step of the way to maximize your financial return.

-

Business Investments

Identify and participate in solid and profitable business investment opportunities. We evaluate established businesses and promising startups, providing you with personalized strategies to diversify your portfolio and grow your capital securely.

-

Financial Services

Access a wide range of financial products designed to protect and grow your wealth. From investment funds and insurance to retirement and savings plans, we create solutions tailored to your needs and financial goals.

EB-5 Business Investment Visa

RONNIE PEREZ, Real Estate Broker

Ronnie Pérez is a licensed real estate agent since 2016, specializing in international investments, business development, and advising on the EB-5 visa program. With a strong background in the real estate sector, he has earned the trust of investors worldwide thanks to his professional approach and in-depth knowledge of the U.S. market. His commitment to excellence and personalized attention make him a standout in the industry.

Ronnie has worked with foreign investors looking to expand their property portfolios in the United States. His expertise spans both commercial and residential real estate, identifying projects with high profitability potential. His global network and experience in complex transactions ensure successful outcomes for his clients.

He also provides guidance in the EB-5 visa process, assisting investors in obtaining permanent residency in the United States through job-creating investments. From project selection to document management, he offers comprehensive and transparent services to meet all legal and financial requirements.

Common EB-5 Immigrant Visa Program Questions

-

The EB-5 program is a U.S. visa program that provides a pathway to permanent residency (a green card) for foreign nationals who invest a certain amount of money in a U.S. business that creates jobs for American workers.

-

As of the latest regulations, the minimum investment amount is $1.05 million, or $800,000 if the investment is made in a targeted employment area (TEA), which is an area with high unemployment or rural areas.

-

A TEA is either a rural area or an area that has experienced high unemployment rates. Investments in these areas have a lower minimum investment requirement.

-

Eligible businesses include new commercial enterprises, which can be either a new business or an existing business that is restructured or expanded. The business must create or preserve at least 10 full-time jobs for U.S. workers.

-

The process typically takes around 18 to 24 months, but this can vary depending on factors such as the complexity of the case and processing times at the U.S. Citizenship and Immigration Services (USCIS).

-

Yes, you can include your spouse and children under the age of 21 as dependents in your EB-5 application. They will also receive conditional permanent residency if your application is approved.

-

If the investment does not meet the program requirements, your application may be denied, and you could lose your investment. It is crucial to ensure that the business and investment meet all the program's criteria and to work with experienced legal and financial advisors.